6 Simple Techniques For Top 30 Forex Brokers

The Main Principles Of Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers for DummiesIndicators on Top 30 Forex Brokers You Need To KnowThe Top 30 Forex Brokers PDFsThe Of Top 30 Forex BrokersEverything about Top 30 Forex BrokersGet This Report on Top 30 Forex BrokersUnknown Facts About Top 30 Forex BrokersAn Unbiased View of Top 30 Forex Brokers

Each bar graph represents one day of trading and includes the opening price, highest rate, least expensive cost, and closing rate (OHLC) for a trade. A dash on the left stands for the day's opening cost, and a similar one on the right stands for the closing price.Bar charts for money trading help investors determine whether it is a buyer's or seller's market. Japanese rice traders first used candle holder charts in the 18th century. They are aesthetically a lot more appealing and simpler to read than the graph types explained above. The upper section of a candle is made use of for the opening cost and greatest rate point of a money, while the lower section indicates the closing rate and least expensive price factor.

The Best Strategy To Use For Top 30 Forex Brokers

The formations and forms in candle holder graphes are utilized to recognize market direction and movement.

Banks, brokers, and dealerships in the forex markets enable a high amount of utilize, indicating investors can regulate huge placements with relatively little money. Take advantage of in the range of 50:1 is usual in forex, though even higher quantities of take advantage of are offered from specific brokers. Take advantage of has to be utilized very carefully since several inexperienced traders have actually experienced significant losses using even more take advantage of than was necessary or prudent.

Facts About Top 30 Forex Brokers Uncovered

A currency trader requires to have a big-picture understanding of the economies of the different nations and their interconnectedness to grasp the principles that drive money worths. The decentralized nature of forex markets implies it is much less controlled than other financial markets. The degree and nature of law in forex markets depend on the trading jurisdiction.

The volatility of a certain money is a feature of numerous variables, such as the national politics and business economics of its nation. Events like financial instability in the form of a settlement default or imbalance in trading connections with an additional money can result in significant volatility.

6 Easy Facts About Top 30 Forex Brokers Shown

Money with high liquidity have a ready market and display smooth and foreseeable cost activity in reaction to outside occasions. The U.S. buck is the most traded money in the world.

Some Known Details About Top 30 Forex Brokers

In today's information superhighway the Foreign exchange market is no longer solely for the institutional investor. The last 10 years have seen a rise in non-institutional investors accessing the Foreign exchange market and the benefits it provides.

:max_bytes(150000):strip_icc()/forex.asp-final-a13505a0ad5a4f519c7677aa151c7113.png)

The 9-Minute Rule for Top 30 Forex Brokers

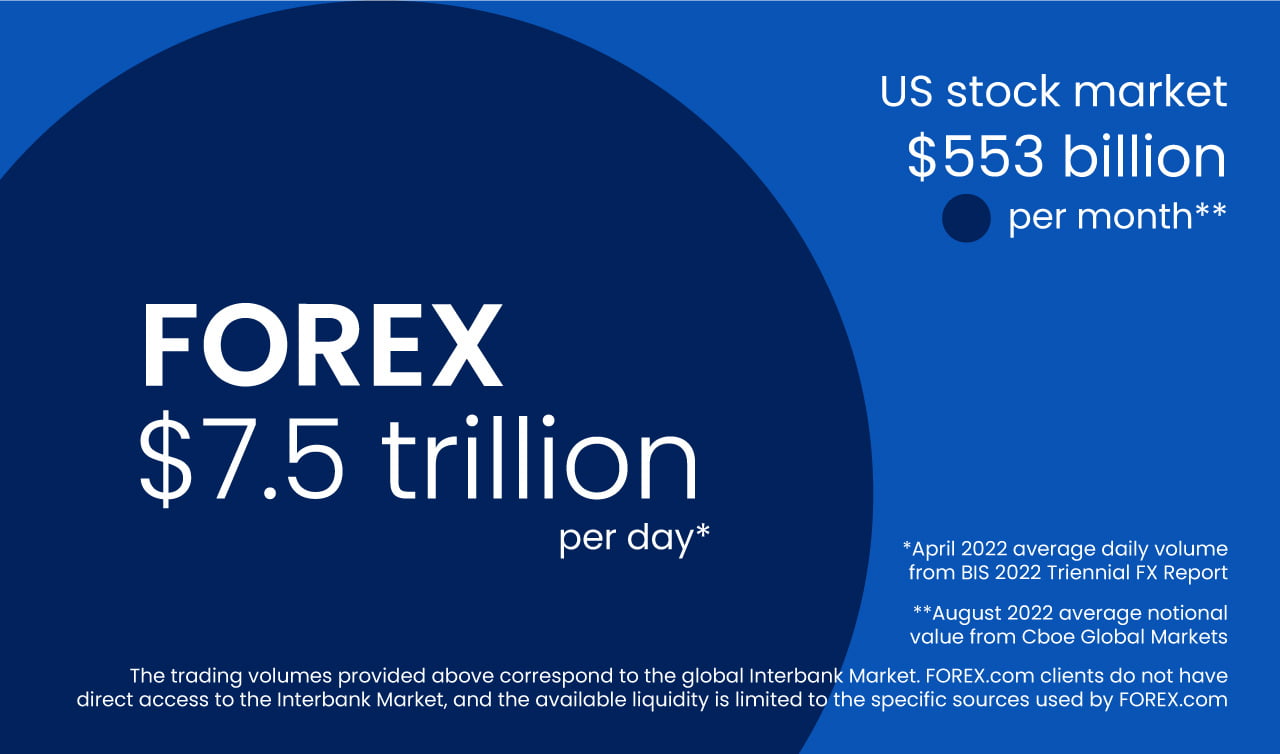

Fx trading (forex trading) is a worldwide market for dealing currencies. At $6. 6 trillion, it is 25 times bigger than all the globe's stock markets. Forex trading determines the exchange prices for all flexible-rate currencies. Because of this, prices change regularly for the money that Americans are probably to make use of.

All currency trades are performed in sets. When you sell your currency, you receive the repayment in a various money. Every vacationer that has actually obtained foreign currency has done forex trading. As an example, when you take place vacation to Europe, you exchange bucks for euros at the going rate. You sell U.S.

The Main Principles Of Top 30 Forex Brokers

Spot purchases are comparable to exchanging currency for a journey abroad. Areas are contracts in between the investor and the market manufacturer, or supplier. The trader buys a particular money at the buy cost from the market manufacturer and offers a different currency at the asking price. The buy price is rather greater than the marketing cost.

This is the deal price to the trader, which in turn is the earnings earned by the market manufacturer. You paid this spread without realizing it when you traded your dollars for my website international currency. You would see it if you made the deal, terminated your journey, and then attempted to exchange the currency back to bucks right away.

Top 30 Forex Brokers Fundamentals Explained

You do this when you think the currency's value will drop in the future. Companies short a money to protect themselves from danger. Yet shorting is very dangerous. If the money climbs in worth, you need to buy it from the dealer at that cost. It has the exact same pros and disadvantages as short-selling supplies.